A note from Oricia Smith, President of Sun Life Global Investments.

Designed by Sun Life Global Investments & Sun Life Group Retirement Services for Choices members in retirement

Canadians need more choice in retirement

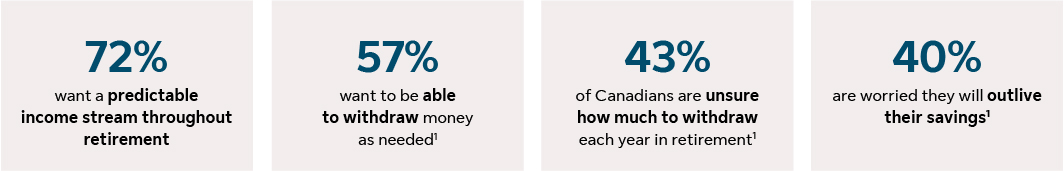

With a growing aging population and the evolution of capital accumulation plans, it is important to support and empower Canadians to feel confident in planning for their retirement. The first step is to understand their needs and determine what Canadians are looking for in retirement income solutions. Sun Life has learned a lot from Canadians approaching retirement:

Industry learnings are key

Many peers in the industry have shared key insights on what is needed to make decumulation successful—and why some past solutions may not have succeeded.

It’s not just about

product

A decumulation solution cannot work on its own. A combination of solutions, advice and member experience are crucial for success.

Ease of use and understanding is paramount

Simplicity is key. If a plan member can’t understand it they won’t use it.

Annuities aren’t the favoured solution

Plan members are not willing to give up access to all of their capital for the guarantee of an annuity—including Target date funds with an annuity option

Filling an important gap

The most important features Canadians are looking for in retirement solutions are predictability of income for life, opportunity for investment returns and flexibility in withdrawal2.

Until now, there was no solution that combined all these features. Sun Life Global Investments collaborated with Sun Life Group Retirement Services (GRS) to design a new solution, Sun Life MyRetirement Income, and with it, a whole new decumulation category: target age solutions. This solution is available exclusively through GRS in their group Choices rollover business. It combines some of the attractive features of an annuity with the flexibility of a traditional LIF/RRIF. Members choose the age they want their money to last until (the "maturity age"), and Sun Life MyRetirement Income is designed to calcuate a sustainable stream of variable income.

Key features that address members needs

Income payments

- Plan members can receive a sustainable stream of variable income designed to last to maturity.

- For payments to last to the selected maturity age, income payments are recalculated annually. The income amount will vary each year based on the remaining account balance, investment returns and changes made the previous year. Income can also vary depending on regulatory minimum and maximum payment requirements.

Flexibility

- Assets are not locked in–plan members can access the entire account balance at any time

- Choice of maturity age and payment frequency—and ability to make changes

Simplicity

- Fully automated solution

- Only one important decision (determine maturity age)

- Easy to understand and use

Growth opportunity

- Savings are invested in Sun Life Granite Moderate Retirement Fund, so they remain well-diversified in a Fund specifically designed for retirees.

This solution simplifies retirement income planning for Canadians by:

Helping retirees live the retirement they can actually afford.

It gives them a budget to know how much they can spend each year, and minimizes the risks that:

(a) they will withdraw too much early in retirement or during meaningful market volatility, and run out of money (overspending) and

(b) they will limit their spending (and lifestyle) for fear of outliving savings.

Providing a “do it for me” solution in retirement, similar to target date funds in the accumulation phase.

63% of Sun Life plan members are currently invested in Target Date Funds3. Target date funds were created to help plan members navigate the complexities of investment planning and automate the accumulation journey. Sun Life MyRetirement Income automates the decumulation journey—making it essentially a reverse target date fund for retirees. Now, members can continue to leave the complex investment decision to experts in retirement too.

Making it easy to leave a legacy for loved ones.

If a member passes away before their chosen maturity age, the savings balance will transfer to the designated beneficiary, skipping the lengthy estate settlement process.

This solution is available exclusively through Sun Life Group Retirement Services.

1 2023 MFS Global Retirement Survey - Canadians

2 Sun Life CARP Retirement Survey 2024

3 Source: Sun Life as of June 30th 2024

All investment solutions are offered as segregated funds for group retirement plans exclusively by Sun Life Assurance Company of Canada, through Sun Life Group Retirement Services, a member of the Sun Life group of companies.

Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc.

SLGI Asset Management Inc. is the investment manager of the Sun Life Mutual Funds.

© SLGI Asset Management Inc. and its licensors, 2024. SLGI Asset Management Inc. is a member of the Sun Life group of companies. All rights reserved.